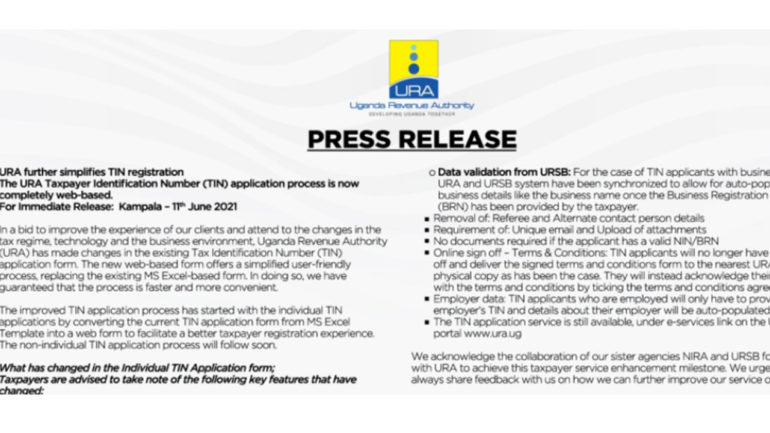

URA has made changes in the TIN numbers and you can now apply online in simple steps. “In a bid to improve the client experience and ease the application process, the individual Tax Identification Number (TIN) application process is now completely web-based. You now say good bye to the old excel form and it’s complexities ,” read the statement on Twitter. The old excel form has now been transformed into a simple web form.

Some other changes that happened is the preregistration data which automatically appears with the NIN number for individual applicants and URSB data for business owners. For individual applicants, NIRA and URA systems have been synchronized and putting your NIN will bring out all that personal identifying information.

For TIN applicants with business, URSB and URA systems have also been synchronized and business information can be retrieved once the Business Registration Number (BRN) has been entered.

Other changes done to improve the process include; Removal of Referee and Alternate contact person details; No uploading of documents is required as long as the applicant has a valid NIN and BRN; and there will be no need to print and sign off the Terms and Conditions.

To apply for URA TIN number online, Click the Link below and follow the steps as provided by URA.

CLICK HERE TO APPLY FOR URA TIN NUMBER

- To register online for registration as an Individual/Non-individual, Enter your email Address and Choose whether you are an individual or not, then click the ‘Proceed’ Button.

- After Clicking Proceed, A unique code will be sent to your email address.

- Kindly copy the OTP and enter it and click the proceed button. A blank page will be opened to allow you fill in the application.

- In the event that you want to resume the application process later, feel free to click the ‘Save For Later’ Button and resume later when you see it fit

- Click the ‘Submit Application’ button to submit your TIN Application.

- At the top right corner is the ‘Log out’ button use it to exit the application window